Monday, March 30, 2009

Sunday, March 29, 2009

Dylan Ratigan leaves Fast Money and CNBC, Doooh!

A comment from another blog that I thought was funny as hell.

Ratigan is leaving? That’s the last time Maw and I will ever watch that show. Even when Melissa “Tweety Bird” Lee was there, I’d throw an old slipper at the fucking tube. Still like Macke and Finerman. Finerman started out utterly inept, must have had a brain transplant because she started making sense. If we aren’t watching that show, nobody will be. The very fact that they were airing Zach “the Middle Stooge” Karabell and Taco Joe “Deer in the Headlights” “Goldman’s is Best of Breed” Terranova was a sign the end was nigh.

Ratigan actually has a fucking brain and some semblance of outrage.

I am going to miss old Dylan. I honestly believe he made that show. I think his only replacement could be Melissa Lee (not a chance in hell) Rebecca Diamond.....

Friday, March 27, 2009

Price by Volume tool used by Brian Shannon

Did some scans tonight.... GRO, MXM, STEM

IQ HEDGE (QAI) - First U.S. listed hedge fund replication ETF

NEW YORK--(BUSINESS WIRE)--The first-ever U.S.-listed hedge fund replication Exchange-Traded Fund (ETF) has been introduced by alternative investment ETF pioneer IndexIQ, it was announced today (Wednesday March 25, 2009, 2:01 pm EDT).

The IQ® Hedge Multi-Strategy Tracker ETF (NYSE Arca: QAI) seeks to replicate, before fees and expenses, the returns of the IQ® Hedge Multi-Strategy Index. The Index is designed to capture the risk-adjusted return characteristics of the collective hedge fund universe using multiple hedge fund investment styles, including long/short equity, global macro, market neutral, event-driven, fixed income arbitrage, and emerging markets.

The ETF-based approach to hedge fund replication offers a number of advantages to investors, including intra-day liquidity, portfolio transparency, lower fees than the typical hedge fund, the elimination of manager-specific risk, and real-time pricing. The IQ® Hedge Multi-Strategy Tracker ETF uses a wide variety of liquid ETFs currently in the market to build the underlying portfolio and does not invest in hedge funds.

“The IQ® Hedge Multi-Strategy Tracker ETF brings together two of the most significant developments in the investment business over the last several years – the growing importance of alternative investments and the convenience, low cost, liquidity and transparency of ETFs,” said Adam Patti, chief executive officer at IndexIQ.

http://finance.yahoo.com/news/IndexIQ-Launches-First-US-bw-14743895.html

Sold some long positions today (SPY, USO)

SPY: In at 68.95, sold today at 82.06

USO: In at 22.93, sold today at 30.94

Thursday, March 26, 2009

Looking for Corporate Bond exposure for your portfolio, but want to use a simple ETF; here are some choices...

So what happened with CBG (CB Richard Ellis Group Inc.)

Wednesday, March 25, 2009

Jeff Macke and the not so informative rant....

Like many others, I have watched Fast Money for a while and have come to the conclusion that all Jeff Macke does lately is spute out meaningless rants about companies and does not offer any constructive opinions regarding the direction of companies or thier equity. While sometimes amusing, he has just become a bore on the show. Pete the caveman Najarian as innocent and nice as he seems (especially when he is on the show wearing his tie and button down shirt and a pair of shorts) is just not used to his fullest because the show does not really highlight options trading, and pretty boy floyd (Tim Seymour) who loves the emerging markets every now and then has relevant information.

Long term holding: PCX

This week I bought some PCX (Patriot Coal Corp NYSE). I am averaged in at 4.71

This week I bought some PCX (Patriot Coal Corp NYSE). I am averaged in at 4.71Patriot Coal Corporation is the third largest producer and marketer of coal in the eastern United States, with 15 active mining complexes in Appalachia and the Illinois Basin. The Company ships to domestic and international electric utilities, industrial users and metallurgical coal customers, and controls approximately 1.8 billion tons of proven and probable coal reserves.

Patriot Coal Results for the Quarter and Year Ended December 31, 2008

Highlights:

Revenues up 113% in fourth quarter and 54% for full year

Significant progress on Magnum integration and mine rationalization plan

Idling of Jupiter, Remington & Black Oak mines

Expected 2009 sales volumes between 36 and 38 million tons

Reduced 2009 capital expenditures to reflect market conditions

I know Obama is against coal due to the environmental effects, however we have to realize that it will take a while for his renewable energy sources to come to fruition in a meaningful sense. America has plenty of coal and it is a cheap power source and China is building coal plants out the ying yang.

Bottom line is that I did not have any coal stocks in my portfolio and the fundies looked pretty good on PCX so I started a position this week. Plus it has been beatin down like a dirty red headed step child.... (no offense to the ginger kids)

Sunday, March 8, 2009

Weekend Scans

ATVI

BIG (the big volume spike I think was a Cramer effect)

ES

FCX (Seems like everyone is piling in on this play for copper and what not, I was already long)

VVTV (Penny stock)

TLB (Inverted Head and Shoulders)

BRP (looking at the nice volume spike and the slow stoch, I think this one is a good candidate as a bottom bouncer)

I am sure all the hoopla on Monday will be about the biotechs, especially anything related to stem cell research...

Good luck and happy trading!

Saturday, March 7, 2009

Tuesday, March 3, 2009

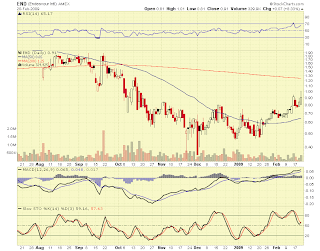

Watch for a cup and handle breakout on LFT

Watch for a cup and handle breakout on LFT (Longtop Financial Technologies). I was reading through their F3Q09 report and they seem to be doing quite well...

Watch for a cup and handle breakout on LFT (Longtop Financial Technologies). I was reading through their F3Q09 report and they seem to be doing quite well...http://seekingalpha.com/article/121351-longtop-financial-technologies-ltd-f3q09-qtr-end-12-31-08-earnings-call-transcript?source=yahoo

Pretty good fundies as well...

http://finance.yahoo.com/q/ks?s=LFT

Saturday, February 28, 2009

Fool in the Shower

He compared the situation to taking a shower. A fool gets into a cold shower before the water has had time to warm up. Rather than waiting for the temperature to adjust, the fool turns the hot water all the way up and eventually scalds himself.

Can you say Inflation!

Buffet in his annual letter to share holders released today made this remark:

Some inflation plays would be:

Long Treasury Inflation Protected Securities, or TIPS:

TIP (iShares Lehman TIPS Bond Fund)

or IPE (SPDR Barclays Capital TIPS ETF)

or WIP (The SPDR DB International Government Inflation-Protected Bond ETF which tracks non-U.S. bonds)

Long Gold or Gold Miners:

GLD (SPDR Gold Shares)

or GDX (Van Eck Market Vectors Gold Miners ETF)

Choose one or the other of the following as your short play. I would rather short the TLT.

Long TBT Ultrashort 20+ Year Treasury Proshares

Short TLT (iShares Barclays 20+ Year Treas Bond)

Right now we have deflation but this is something to think about for the future.....

Friday, February 27, 2009

Letter from Omaha

Warren Buffett's annual letter to Berkshire Hathaway shareholders will be released Saturday morning at 8 am EST

Warren Buffett's annual letter to Berkshire Hathaway shareholders will be released Saturday morning at 8 am ESTBerkshire class A shares have dropped 44% in the past year

Berkshire is expected to report quarterly operating earnings of $1,486.50 per Class A share

Within the past year, Buffett bought $5 billion in the preferred stock of investment bank Goldman Sachs Group

He also invested $3 billion in preferred shares issued by General Electric Co.

The deals came with warrants that give Berkshire the right to buy 43.5 million Goldman shares at $115 each and 134.8 million shares of GE at $22.25 each. These contracts expire in October 2013

Goldman and GE are paying Berkshire 10% a year in dividends for five years

Berkshire also recently invested in bonds issued by companies including Tiffany & Co. and Harley-Davidson Inc. These securities pay 10% to 15% a year.

MOS Buyout?

Thursday, February 26, 2009

SNWL

Breakout.....

MF and DITC charts kind of peaked my interest if you want to check them out....

CPRK for you penny players.... (I do not know if you may have noticed this but allot of times when a commodity is hot it usually trickles down from the majors to the juniors within a couple days or weeks and you can usually catch the juniors before the big runs. I have been hearing alot about copper lately and now Copper King Mining Corp is getting some action. It usually does not matter if it is some crap penny stock; if it has the hot commodity in it's name it still has a good chance of running just because of the name)

Wednesday, February 25, 2009

Tuesday, February 24, 2009

Some bullish moves for today

| Symbol | Last | Chg(%) | Vol |

| S | 3.58 | 8.16 | 74967000 |

| F | 2 | 15.61 | 33935300 |

| RF | 3.29 | 22.3 | 28267500 |

| Q | 3.46 | 3.28 | 21313700 |

| MI | 4.51 | 25.98 | 13692900 |

| AMR | 4.72 | 7.76 | 9788700 |

| GCI | 4.08 | 11.48 | 8724600 |

| SNV | 3.06 | 17.69 | 8499700 |

| FRE | 0.54 | 8 | 8404900 |

| MGM | 4.45 | 4.22 | 6423700 |

| SFI | 1.53 | 56.12 | 5480200 |

| PDS | 2.44 | 2.52 | 3063500 |

| SWHC | 3.53 | 15.74 | 3014900 |

| CNB | 0.51 | 21.43 | 2558100 |

| PKD | 1.71 | 33.59 | 2420700 |

| CROX | 1.37 | 19.13 | 2197700 |

| CNO | 1.54 | 30.51 | 2060400 |

| PEI | 4.38 | 19.35 | 1615500 |

| MPEL | 3.2 | 31.15 | 1480200 |

| CRBC | 0.94 | 17.5 | 1424000 |

| AOI | 3.52 | 6.02 | 943100 |

| BWS | 3.97 | 6.43 | 868100 |

| SBGI | 1.14 | 14 | 862200 |

| FTBK | 1.73 | 42.98 | 765800 |

| AXL | 1.14 | 31.03 | 730100 |

| CEGE | 0.26 | 13.04 | 702400 |

| ARCC | 3.93 | 11.97 | 687700 |

| KKD | 1.41 | 10.16 | 650500 |

| BGP | 0.61 | 15.09 | 571100 |

| FED | 0.46 | 31.43 | 516500 |

| LEE | 0.48 | 4.35 | 492100 |

| UCBI | 3.87 | 14.5 | 488100 |

| BAC-E | 4.6 | 33.33 | 456800 |

| MOD | 1.02 | 13.33 | 453600 |

| CCRT | 2.2 | 13.99 | 452400 |

| PIR | 0.41 | 46.43 | 429700 |

| QRCP | 0.27 | 17.39 | 305900 |

| ICOG | 0.46 | 58.62 | 241500 |

| MEG | 1.9 | 13.77 | 162900 |

| JRT | 2.96 | 10.45 | 100100 |

Monday, February 23, 2009

AXP Pays to close account

Saturday, February 21, 2009

Long Term Holdings: MSFT

This week for my long term holdings I bought some MSFT, or Mr. Softy as Cramer would say.....

Average Position: 17.99

Every week I add to my long term holdings and I will post what I bought....

CHS Third times a charm.....

CHS bounced for the third time against the trendline and looks poised to break through resistance around 4.48

I like to see the slow stoch like that with higher highs and higher lows, looks bullish.

.png)

http://whatstrading.com/

http://whatstrading.com/

Nice W Bottom...

Nice W Bottom...