He compared the situation to taking a shower. A fool gets into a cold shower before the water has had time to warm up. Rather than waiting for the temperature to adjust, the fool turns the hot water all the way up and eventually scalds himself.

Can you say Inflation!

Buffet in his annual letter to share holders released today made this remark:

Commenting on the federal government's actions to resolve the economic crisis, Buffett said: "Economic medicine that was previously meted out by the cupful has recently been dispensed by the barrel. These once-unthinkable dosages will almost certainly bring on unwelcome aftereffects."

Inflation is likely to be one such effect, Buffett said.

Some inflation plays would be:

Long Treasury Inflation Protected Securities, or TIPS:

TIP (iShares Lehman TIPS Bond Fund)

or IPE (SPDR Barclays Capital TIPS ETF)

or WIP (The SPDR DB International Government Inflation-Protected Bond ETF which tracks non-U.S. bonds)

Long Gold or Gold Miners:

GLD (SPDR Gold Shares)

or GDX (Van Eck Market Vectors Gold Miners ETF)

Choose one or the other of the following as your short play. I would rather short the TLT.

Long TBT Ultrashort 20+ Year Treasury Proshares

Short TLT (iShares Barclays 20+ Year Treas Bond)

Right now we have deflation but this is something to think about for the future.....

.png)

http://whatstrading.com/

http://whatstrading.com/

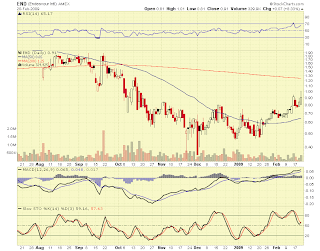

Nice W Bottom...

Nice W Bottom...